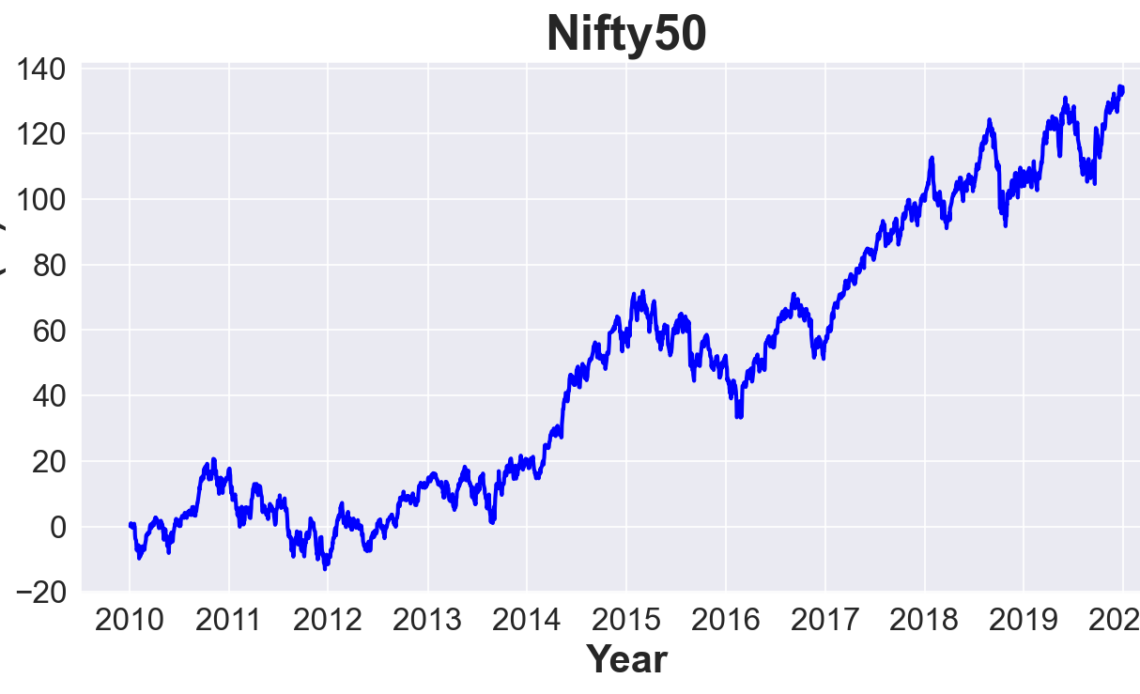

Launched in 1996, the Nifty 50 index is arguably the most popular benchmark of Indian Stock Markets. In its over 25 years, the index has become an elite club where every company listed on exchanges wishes to join. Nifty 50constitutes 50 stocks from 13 sectors as of today. These constituents have not been static. Theindex composition has changed many times as the Indian economy has grown. It will continue to evolve in the future.

What is Nifty 50?

Nifty50 is an index that tracks the share prices of 50 stocks; usually, the 50 most valued firms, traded on the National Stock Exchange. Along with Bombay Stock Exchange Sensex, a similar index tracking 30 stocks, it is considered a mirror of the market and, by extension, the Indian economy.

Nifty 50 indexesare owned and managed by NSE Indices Limited, a unit of NSE. Its constituents are the largest and most liquid stocks, being leaders in their respective segment with years of established track record. It is a float adjusted market capitalisation weighted index used to benchmark fund portfolios, index-based derivatives, and Index Funds.

How are stocks selected in Nifty?

Constituents of the Nifty 100 index available for trading in NSE’s Futures & Options segment are eligible for inclusion in the Nifty 50. Nifty 100 is another index that tracks 100 of the largest and most liquid stocks listed on NSE. The index gets reshuffled twice a year, which leads to the exit or entry of stocks. NSE Indices Limited looks at liquidity, market capitalisation, frequency of trade, and the current composition of the index to decide on its constituents.

What are the current constituents?

Currently, the Nifty 50 has 13 sectors, with Financial Services having the largest weight at around 37%, followed by IT (17%) and Oil & Gas (13%). But this has not always been the same. When Nifty 50 was first constituted, it had no representation from the IT sector and was dominated by consumers, government-owned companies, and heavy industries like metals and autos.

Private banks also do not enjoy the position they do today. Only 13 stocks, part of Nifty in 1996, remain in the index. Reliance Industries (10.86%), HDFC Bank (8.58%), Infosys (8.49%), ICICI Bank (7.23%), Housing Development Finance Corporation (6.02%), Tata Consultancy Services (5.11%), Kotak Mahindra Bank (3.60%), Larsen & Toubro (3.04%), State Bank of India (2.73%) and Hindustan Unilever (2.68%) are the top 10 constituents as of January 2022.

What will Nifty look like in the future?

Change has been the only constant for Nifty 50. As India is growing, new economy segments are becoming more mainstream. We are seeing massive investments in fin-tech, edu-tech, software, consumer-focused technology platforms, and some tech-based supply chain management companies.

The biggest drivers of this new breed of companies in India are increasing formalisation in all segments of the economy, especially finance and consumption, and growing internet penetration. The business ideas based on these themes are reshaping the Indian economy. Their dominance will increase.

As IT and private banks replace stocks from the old age economy over the previous two decades, the new-age companies utilising these economic drivers will knock on Nifty’s doors in the coming decade. However, no one can be sure which stocks will enter Nifty 50 in the next 10 years; going by the churning rate, the index may see as many as 20 new entrants.

Disclaimer – ICICI Securities Ltd. (I-Sec). Registered office of I-Sec is at ICICI Securities Ltd. – ICICI Venture House, AppasahebMarathe Marg, Prabhadevi, Mumbai – 400 025, India, Tel No : 022 – 6807 7100. I-Sec is a Member of National Stock Exchange of India Ltd (Member Code :07730), BSE Ltd (Member Code :103) and Member of Multi Commodity Exchange of India Ltd. (Member Code: 56250) and having SEBI registration no. INZ000183631. Name of the Compliance officer (broking): Mr. Anoop Goyal, Contact number: 022-40701000, E-mail address: complianceofficer@icicisecurities.com. Investment in securities market are subject to market risks, read all the related documents carefully before investing. The contents herein above shall not be considered as an invitation or persuasion to trade or invest. I-Sec and affiliates accept no liabilities for any loss or damage of any kind arising out of any actions taken in reliance thereon. The contents herein above are solely for informational purpose and may not be used or considered as an offer document or solicitation of offer to buy or sell or subscribe for securities or other financial instruments or any other product. Investors should consult their financial advisers whether the product is suitable for them before taking any decision. The contents herein mentioned are solely for informational and educational purpose.