Imagine turning small, regular investments into a structured investing habit; that’s how a Systematic Investment Plan (SIP) is commonly used. By investing a fixed amount every month into a mutual fund, you not only build discipline but also stay consistent over time.

Tracking your SIP is not about predicting outcomes or setting expectations. It is about how regular investing interacts with time, market movement and your own commitment. This is where a SIP calculator plays a role.

What is a SIP calculator and what does it actually do

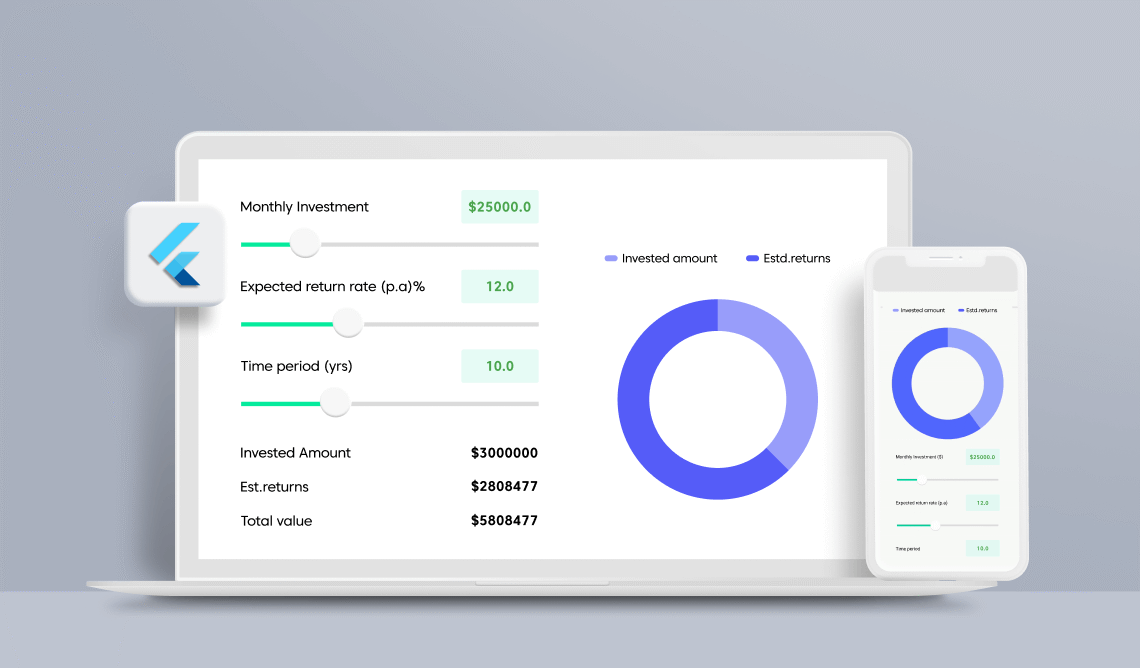

A SIP calculator is a simple online tool that helps you visualise how your periodic investments may build over a chosen time frame, based on assumed inputs. It is not a forecast. It is a way to observe patterns and scenarios.

A SIP calculator uses basic inputs to create an illustration of how your investments might evolve over time. Most calculators ask for:

- The amount you plan to invest regularly

- The duration of the SIP

- An assumed rate of return used only for illustration

The calculator shows how your total investments could grow compared to the projected value over the chosen period. Think of it as a helpful scenario, not a guaranteed result. Remember, as SEBI and other regulators highlight, mutual fund investments come with market risks, and these projections are only illustrative—they don’t promise future returns.

Using a SIP calculator: Step-by-step process

Using a SIP calculator is straightforward, but each input plays a specific role in shaping the entire process.

Step 1: Enter your SIP amount

Start by entering the amount you intend to invest at regular intervals (mostly monthly SIPs). Choose a figure that fits comfortably within your monthly budget. The calculator can be really helpful if the input reflects realistic behaviour rather than ideal assumptions.

Step 2: Choose the investment duration

Next, select the period for which you plan to continue the SIP. This could be for a few years or longer. Time plays a significant role in SIPs, and the calculator helps you see how consistent and longer durations can let you benefit from the power of compounding.

Step 3: Use the assumed rate carefully

Most SIP calculators include an assumed rate for calculation purposes. This rate is not a reflection of any scheme’s performance. Treat it as a variable that helps you explore different possibilities, not as an expectation.

Step 4: Review the output

Once you have entered all your details, the SIP calculator will display the expected future value of your investment. You can change the variable to see how different scenarios affect your future corpus.

SIP calculator for tracking, not predicting

A SIP calculator becomes more useful when you revisit it periodically. For example, if your income changes, expenses rise, or there is a change in your financial goal, you can adjust the inputs and see how the calculator responds.

This process supports planning, not decision-making in isolation, as SIP calculators are meant to aid understanding and should be used alongside scheme documents and risk disclosures.

You can also use the calculator to:

- Compare different SIP amounts

- Understand how extending or shortening the duration changes the illustration

- Check whether your current SIP aligns with your broader financial approach

Bottom Line

A SIP calculator does not tell you what will happen. It helps you understand what could happen under certain assumptions. Used thoughtfully, it can support awareness, discipline and better engagement with your investment approach.

By focusing on behaviour, time, and consistency, rather than outcomes, you can use a SIP calculator as a tracking and learning tool.